Express Online

Online loan in the My O! app Quick process, 24/7

Scan QR to download the app

The Express online loan is only available to residents of the Kyrgyz Republic

Up to 200,000 online

24/7 and without leaving home

Repayment period: up to 2 years

Good timeframe: 3 to 24 months

Good interest rates starting at 26.99%*

Transparent terms and minimum overpays

Minimum document set

Only passport required, nothing extra

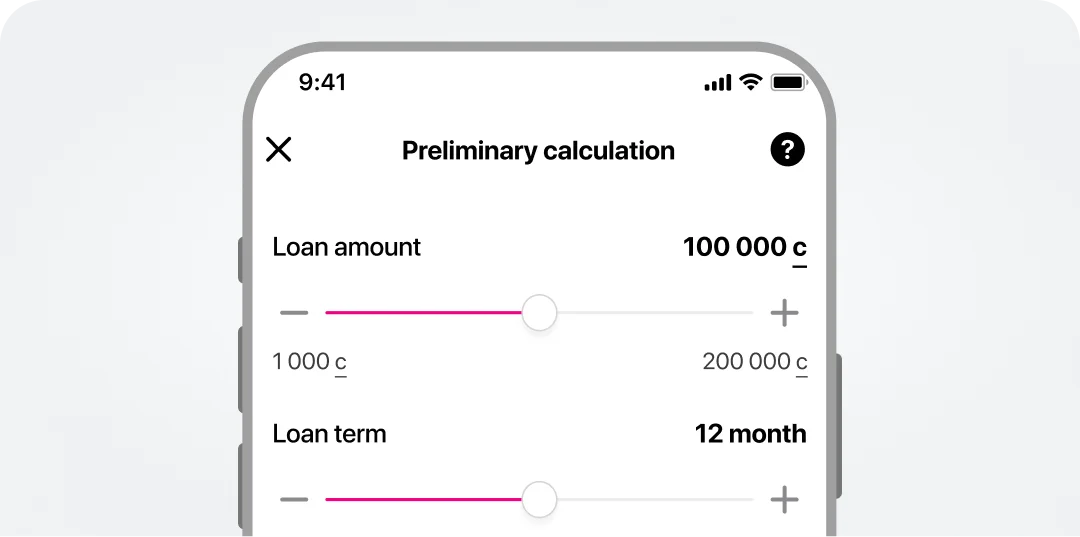

Calculate a loan

How to get a loan in the app?

Step 1

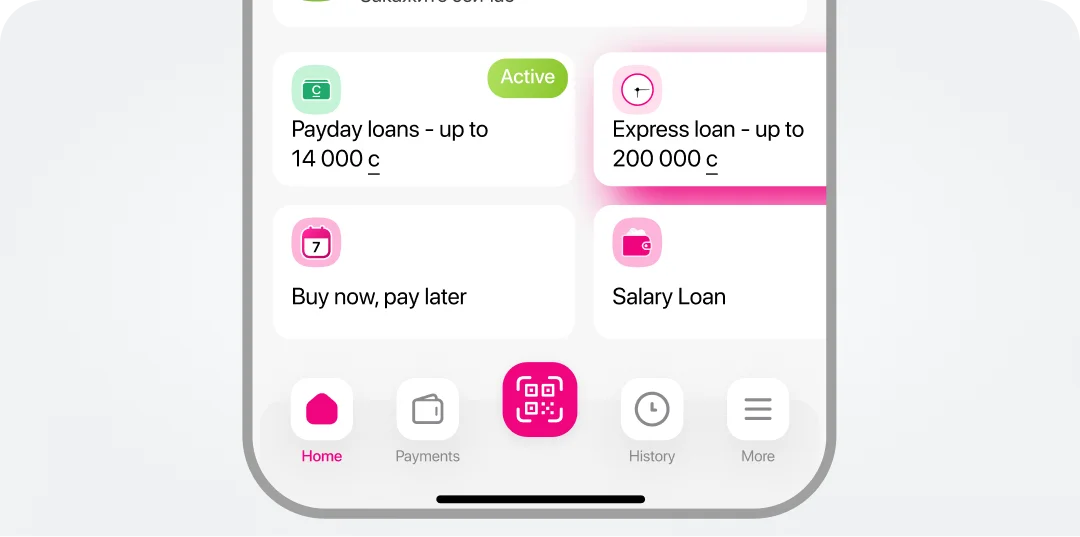

Select the "Express loan" on the app's main screen

Step 2

Indicate the loan amount, period and first repayment date, and then submit application

Step 3

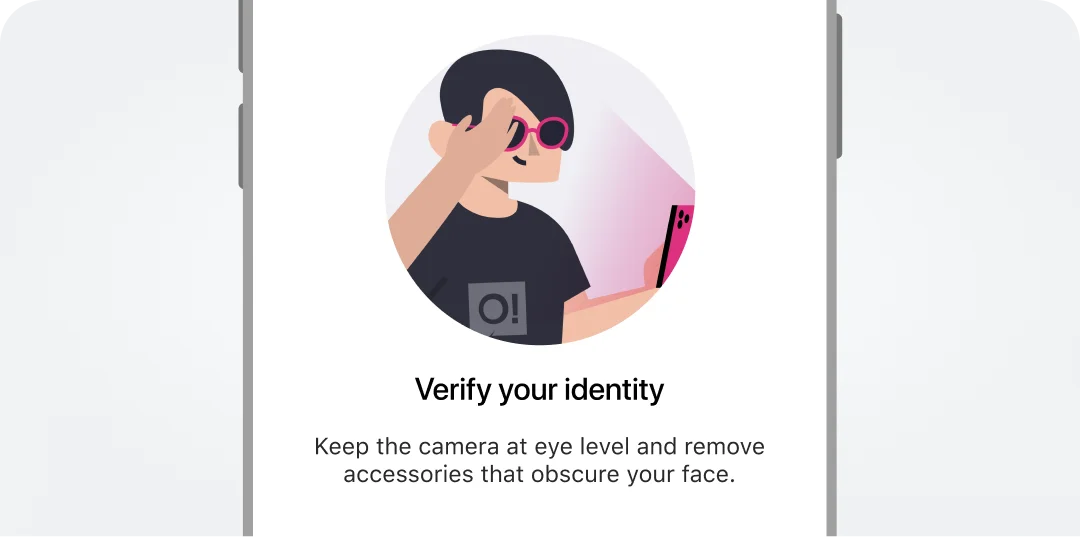

Confirm your identity

Step 4

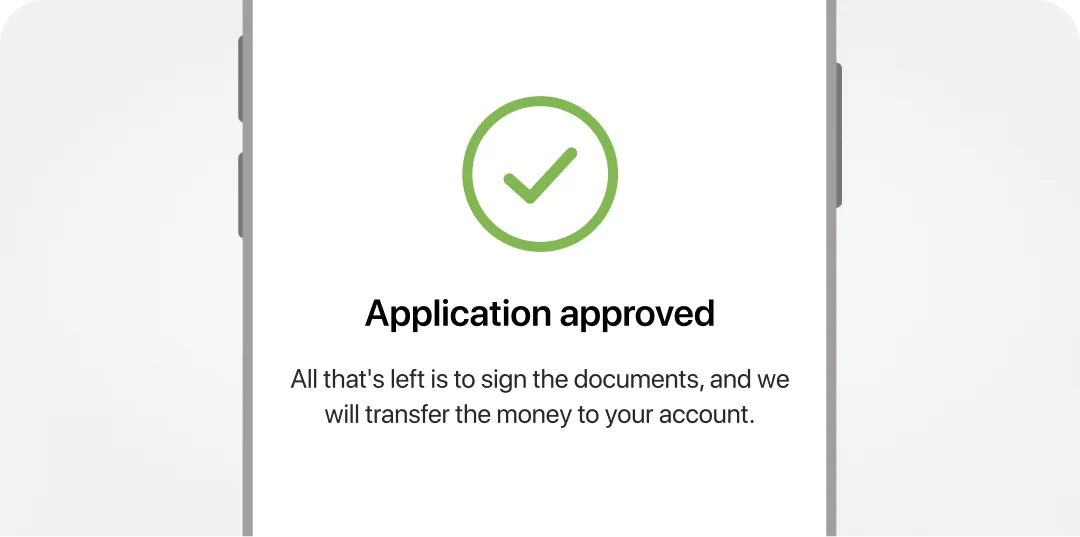

Wait until the application is approved

Step 5

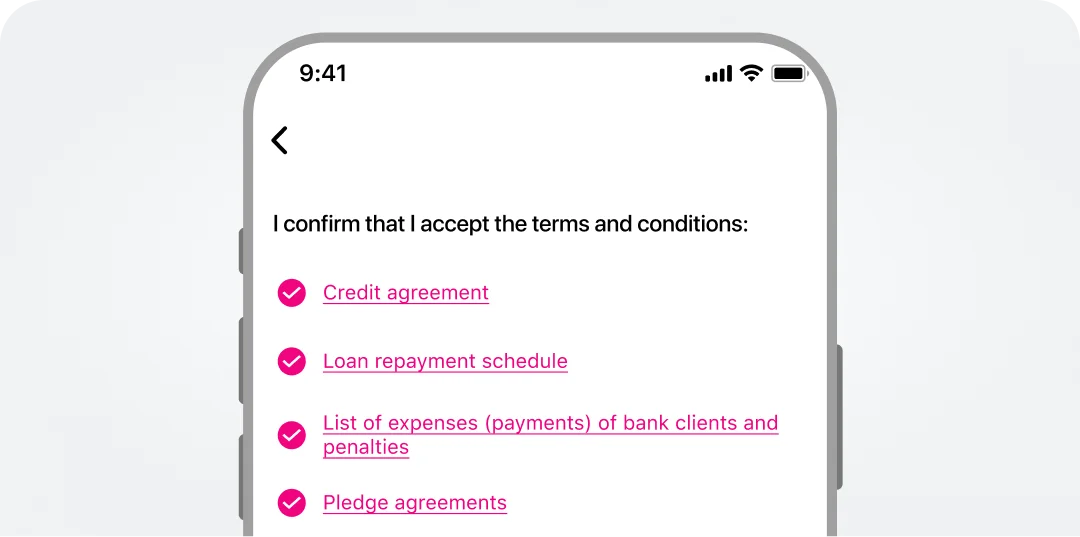

Sign documents online

Step 6

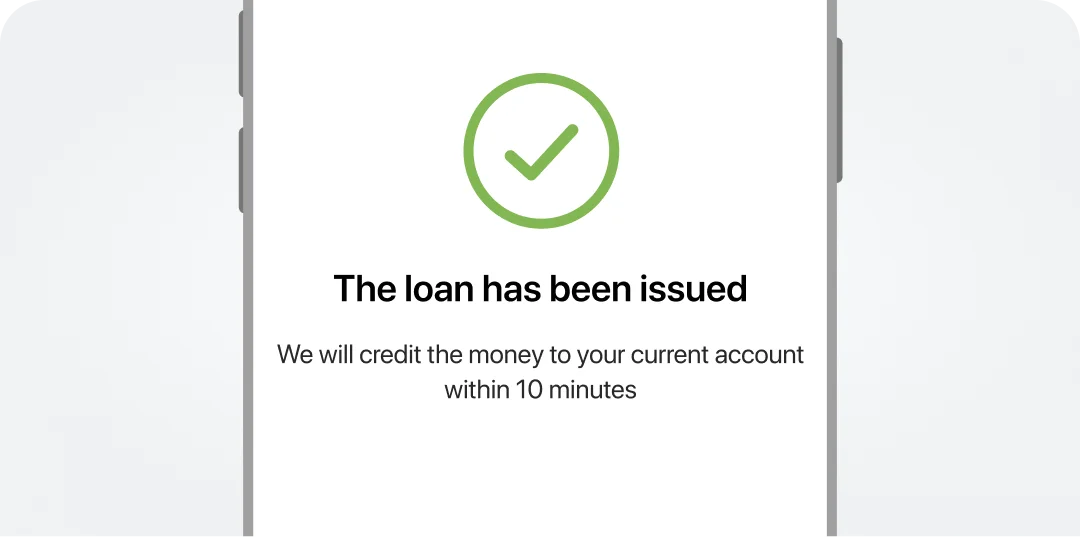

Done! Wait for crediting

Cooling period

Starting on December 14, 2024, the “cooling period” will be applied to online loans as required by NBKR.

How does it work?

Money will be credited as follows after the loan application submission:

- 15,000 to 50,000 KGS: 30 minutes;

- 50,001 to 100,000 KGS: in 4 hours;

- 100,001 to 200,000 KGS: in 12 hours.

In case of a loan over 100,000 KGS, control call is required for loan confirmation.

Intended use of loan

Once approved, the loan will be credited to the special loan account. You can use them free of charge for buying goods and services by QR or paying for services via My O!.

Non-purpose use of funds

- transfers to individuals (to accounts, cards, wallets, phone number, QR);

- topping up a mobile service account;

- repayment of loans or installment plans provided by other banks and finance and credit institutions.

Other expenditures: 1.95% of the transaction amount charged for non-purpose transactions

Accident Insurance

The lending products Express Online and Payroll include accident insurance. The insurance fee depends on the way the loan is issued and loan term.

General terms and conditions:

When applying for an online loan in the My O! app, the customer can choose an insurance company:

- IC Sakbol;

- IC Arsenal Kyrgyzstan.

A loan without insurance can be arranged at an O!Bank office.

For online loans in the My O! app

- 3–12 months: 2.25% of the loan amount;

- 13–24 months: 4.5% of the loan amount.

Sample calculations:

- For 100,000 soms borrowed online for 12 months: 100,000 × 2.25% = 2,250 soms.

- For 100,000 soms borrowed online for 24 months: 100,000 × 4.5% = 4,500 soms.

Self-ban on obtaining loans

Starting November 1, 2025, the law on self-ban for loans comes into effect in Kyrgyzstan.

What it is:

- A self-ban is a voluntary restriction that blocks the issuance of loans in your name — including those you apply for yourself.

How to set or remove it:

- Through the Tunduk government portal;

- The procedure is free and applies to all banks and microfinance institutions (MFIs);

- Removal takes effect 12 hours after submitting the request.

Why it’s needed:

- Protects against fraudulent loans;

- Helps prevent impulsive financial decisions.

Important:

- If a self-ban is active, loan applications will not be accepted.

- To apply for a loan, remove the self-ban via the Tunduk government portal.

FAQ

How can I get an online loan in Bishkek through O!Bank?

Submit a loan application online in the My O! app anytime, even on weekends. You only need to complete identity verification once at any O!Bank office or O!Store, after which online loans will be available to you. The review process takes just a few minutes.

What types of online loans are available in My O!?

- Payday loan – up to 14,000 KGS, issued within a couple of minutes;

- Express loan – up to 200,000 KGS, no collateral or guarantors required;

- Installments – 0% interest and no fees on O!Market.

Can I get an online loan without documents?

To apply for an online loan, you only need to complete identity verification once with your passport at any O!Bank office or O!Store. After that, you’ll have 24/7 access to online loans of up to 200,000 KGS.

Where can I get an urgent online loan without rejection in Bishkek?

You can apply through the My O! app. If approved, the money is quickly credited to your account.

Which bank offers the lowest interest rate in Kyrgyzstan?

The rate depends on the type of loan and your credit history. O!Bank offers favorable terms — details are available on the Loans page.

Can I get an online loan to my card?

Once approved, the loan will be credited to the special loan account. They can be used for paying for goods or service via My O!. 1,95% fee is charged for transfers to cards and other non-purpose transactions.

Where can I get microloans online?

The My O! app offers fast loans of up to 14,000 KGS with instant processing 24/7.

Can I get a loan in Bishkek without visiting a bank?

Yes, you can apply and receive funds fully online. You only need to complete in-person identity verification once at any O!Store or O!Bank.

What time can I apply for an online loan at?

Applications can be submitted 24/7, including weekends. The decision takes just a few minutes.

What are the requirements for getting an online loan from O!Bank?

- be a Kyrgyzstan national;

- have a passport;

- have a good credit history;

- complete identity verification once at an O!Bank office or O!Store;

- install the My O! app.

You can calculate your loan using the user-friendly loan calculator on the website or in the app.

How can I get a consumer loan?

You can apply for a consumer loan from 200,000 to 4,000,000 KGS on the website. Our specialists will contact you for consultation and details.

What is a self-ban?

A self-ban is a voluntary restriction that blocks the issuance of any loans in your name — including those you personally apply for. The self-ban is set through the state portal Tunduk and applies to all credit institutions in the country.

Why is a self-ban important?

- Protects you from fraudulent loans taken out by scammers in banks or microfinance organizations.

- Helps you avoid impulsive or risky financial decisions.

How can I set up or remove a self-ban?

Through the Tunduk state portal. Any changes are automatically transmitted to all credit institutions in the country via the Credit Bureau.

What happens if I apply for a loan while a self-ban is active?

The bank will verify your status and reject the application. A message will appear on the screen stating that loan issuance is currently unavailable.

Can the bank remove a self-ban without my consent?

No. You are the only person who can manage the self-ban through the Tunduk portal. The bank has no authority to lift the restriction — even if you already have active loans.

Hurry up to take an online loan in My O!

*EPAR from 30.49%.