Money Box Plus

Online deposit with monthly interest payouts

Scan QR to download the app

The Online Money Box deposit is available to non-residents of the Kyrgyz Republic who have passed identity verification at any O!Bank or O!Store office

A good rate

Up to 12,5% p.a. in KGS, 3% in USD and 1% in EUR

Regular income

Monthly interest payment

Top-ups allowed

No amount limitations during the first half of the term

Deposit security

Deposit security guaranteed, up to 1,000,000 KGS

Calculate the Money Box Plus deposit profit

Interest accrued for the period

45 с

Amount payable by period end

1045.00 с

Preliminary estimates. Not a public offer.

Interest to be paid upon early termination

from 6 months: 50% of amount accruals

from 9 months: 60% of amount accruals

For deposits opened before March 19, 2025, interest is not paid in case of early termination

EPAR: up to 13.44% in KGS

Deposit terms

Interest payment on a monthly basis

Active top-up period: the first half of the term

Partial interest payment in case of early termination

No partial withdrawal

Minimum deposit amount: 1000 KGS, 10 USD, 10 EUR

Apply online in My O! or at an O!Bank office

All rates

| Period | % rate, KGS | % rate, USD | % rate, EUR |

|---|---|---|---|

| 3mths | 5% | 0,5% | 0,3% |

| 6mths | 9% | 1% | 0,5% |

| 12mths | 12,5% | 3% | 1% |

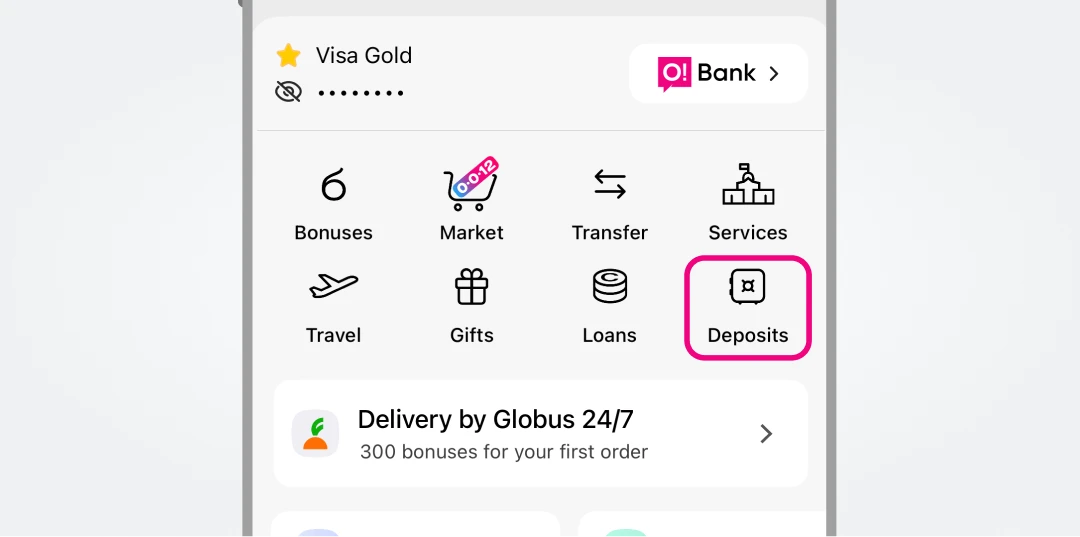

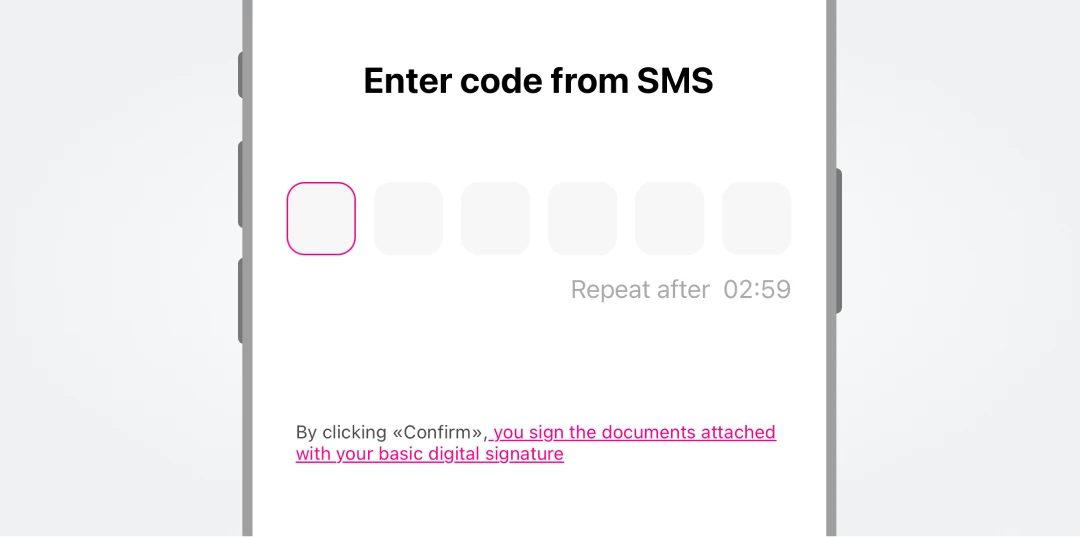

How to open a deposit in My O!

Step 1

Choose the O!Bank section on the home page

Step 2

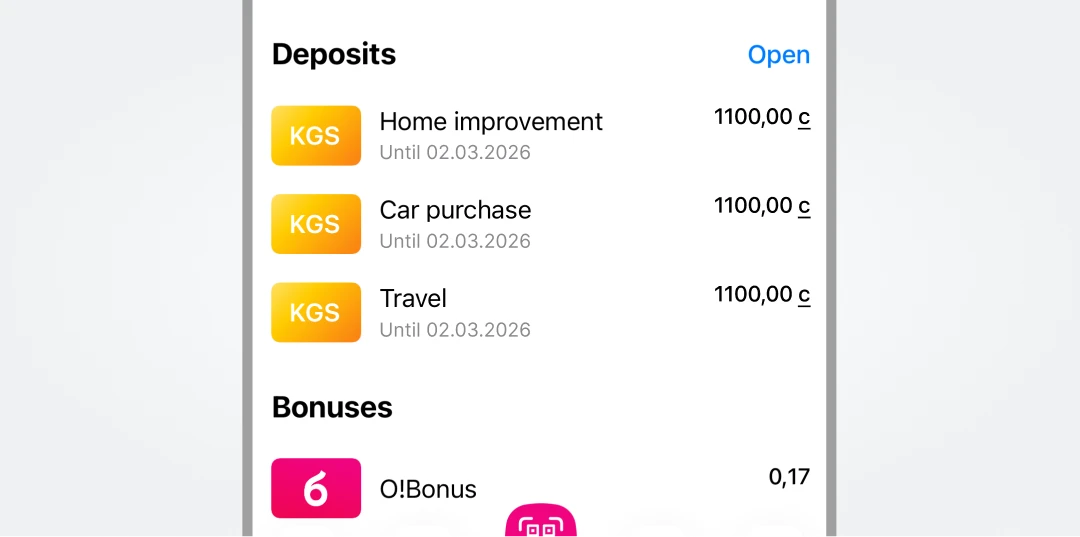

Open the "Deposits" section and click "Open"

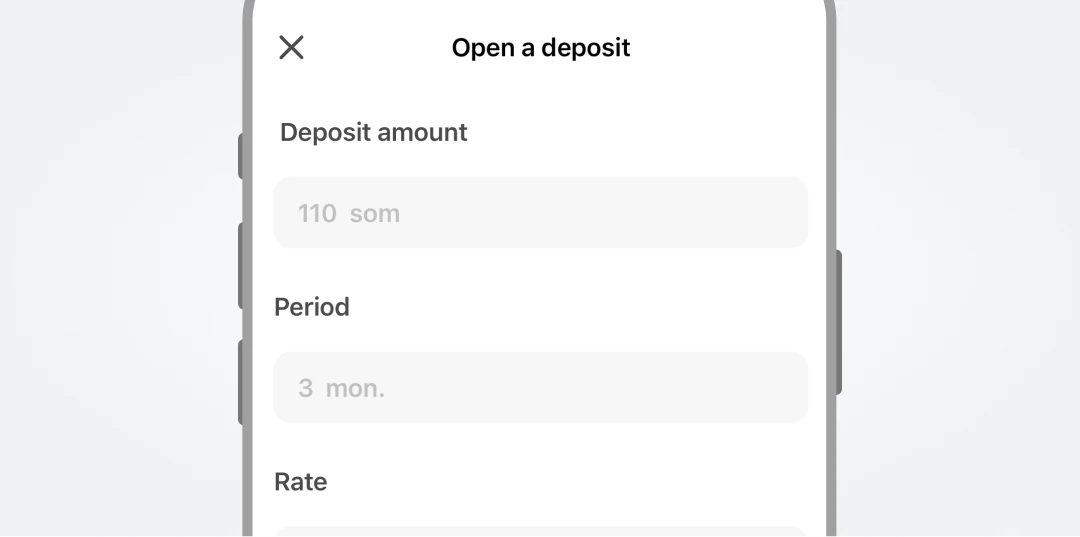

Step 3

Fill out all fields and confirm data

Step 4

Sign documents online

Step 5

Done! Your deposit will be displayed in the O!Bank section

FAQ

What is a deposit and how does it work in Kyrgyzstan?

A deposit (or savings account) is a way to save and grow your money. You place funds in a bank for a fixed term, and the bank pays you interest. At O!Bank, you can open a convenient online deposit in KGS with up to 13% annual interest, as well as deposits in USD and EUR. The term ranges from 3 to 24 months. This is one of the most reliable and profitable ways to accumulate and increase capital in Kyrgyzstan.

How to open a deposit?

In the My O! superapp for the Kyrgyz Republic nationals:

- Click “Deposits” on the main screen → “Open”

- Select period and amount

- Sign documents online

- Your deposit will appear in the “O!Bank” section

For foreign nationals: at any O!Bank office, with an ID document.

Deposit opened at a bank office will also appear in My O!

How to top up the deposit?

Right in the app, in the “Deposits” section, without fees.

Via other mobile apps or cash-in terminals: “O!Bank deposit top-up”.

How to top up a USD deposit account?

In the section “Transfers between own accounts” of the O!Bank mobile app, and at O!Bank offices.

How is interest accrued and paid out?

Interest is accrued on a daily basis, on the remaining amount as of the day beginning, and paid out on a monthly basis by crediting to the bank account. The interest paid can also be credited back to the deposit account.

Is partial withdrawal of the deposit available?

Partial withdrawal from the Money Box Plus deposit is not available.

What if I terminate my deposit early?

If the deposit period is 12 or 24 months:

- in case it is terminated upon 6 months, 50% of the interest accrued will be paid out;

- in case it is terminated upon 9 months, 60% of the interest accrued will be paid out.

If the deposit period is 3 or 6 months, the interest will not be paid in the event of early termination. The whole interest amount will be cancelled.

For deposits opened before March 19, 2025, interest is not paid in case of early termination.

How many deposits can I open?

You can open as many deposits as you want, there are no limits.

What amounts can be transferred to the deposit account via wallets and bank accounts?

For users with identity verified online: 10,000 KGS at a time.

For users with identity verified in person: depending on the payment source:

- from card: 700,000 KGS per day

- from wallet: 300,000 KGS at a time

- from account: no limits

What rate will be applied if deposit is extended?

The rate effective as of the extension date will apply to the extended deposit. For example, if 16% rate applied to the deposit until April, and then, in April, the rate changed to 14%, the 14% rate will apply to the extended deposit.

How to find the deposit account number?

Open My O!, and then O!Bank, select the opened deposit and click “Deposit details”.

Is security guaranteed for the money?

O!Bank is a member of the Kyrgyz Republic Deposit Protection System, so, disbursement of up to 1,000,000 KGS is guaranteed to every deposit holder if a warranty event occurs. Find out more on deposit.kg.

How to obtain documents for an opened deposit?

Open the Deposit Details tab, you can view and download all available documents in the Documents section.

How to close a deposit?

You can close your deposit directly in the My O! app:

- 1. Open “O!Bank” → “Savings”.

- 2. Select the deposit you want to close and tap “Actions” → “Close deposit”.

- 3. Review the closing terms.

- 4. Select the reason for closing and confirm the action.

- 5. The funds will be transferred to your linked bank account.

Important:

- If you close your deposit early, part or all of the interest may be withheld — carefully review the terms on the screen before confirming.

- Funds are credited immediately after closing (sometimes within the business day).

Online closing may be unavailable if:

- The amount exceeds the allowed in-app closing limit. For deposits over 1 000 000 KGS, USD2,300 USD, or 2,000 EUR, please visit an O!Bank office.

- Technical maintenance is in progress.

How is deposit interest calculated?

Interest is accrued on a daily basis on the current deposit balance and is calculated based on the following formula (1 year = 360 days):

Interest for the day = (account balance × per annum rate) / 360

What is the start date for interest accrual?

Interest accrual starts on the date following that of the deposit opening. The opening date is not counted for in calculation, therefore, the total number of days for interest accrual is 359.

How is the interest accrual period calculated?

Interest is accrued for a conditional year consisting of 360 days.

Furthermore:

- Every month is considered consisting of 30 days irrespective of the actual number of days, i.e. 28, 29 or 31

- The deposit’s last month is considered consisting of 29 days

Why does the formula count 360 days, not 365?

Banking calculations are based on the 30/360 method which means that each month is considered to consist of 30 days and each year is considered to be 360 days long. This system simplifies and standardizes calculations. In fact, interest is calculated for 359 days as the opening day is not included in the calculation. The 360-day formula already takes this into account and the accrual amount will be accurate.

How is interest calculated upon deposit top-up?

On the top-up day, the interest is accrued on the balance before the top-up.

The interest is accrued on the top-up amount on the next business day along with the interest accrued on the new deposit amount.

After that, interest is accrued on the new amount on a daily basis.

The top-up amount added after 20:00 or during the weekend is counted on the next business day.

Example:

- 100,000 som deposit is opened on April 1

- The deposit balance is 100,000 soms, the rate is 16.5%

- Daily interest: (100,000 × 16.5%) / 360 = 45.83 soms

April 9:

- You added 4,000 soms to your deposit. This day, the interest is accrued on the amount before the top-up.

- Accrued for April 9: 45.83 soms

April 10:

- Interest is already accrued on the new amount.

- (104,000 × 16.5%) / 360 = 47.67 soms

- Accrued for April 10: 47.67 soms

O!Bank is a member of the Kyrgyz Republic Deposit Protection System. According to the Kyrgyz Republic Law on Protection of Bank Deposits, all deposits are insured, and deposit holders are titled to be paid up to 1,000,000 KGS in a warranty event. Find out more on deposit.kg

Hurry up to take an online loan in My O!

Effective interest rate for fixed-term deposits is 5.19% to 13.44% in Kyrgyz soms, 0,51% to 3,10% in US dollars and 0,30% to 1,02%, depending on deposit terms. The interest is accrued based on 360-day year and 30-day month. The above rates are per annum. The interests are accrued on the deposit starting on the date following that of the deposit receipt by the bank and until the date preceding to that of the deposit period end. Interests are paid out on a monthly basis. The deposit amount is paid out on the date following that of the deposit period expiry. Deposit may be extended automatically for the same period and on the same terms, with rates effective on the contract extension date. The bank reserves the right to set fees and interest rates other than specified above for customers on an individual basis, depending on the amount of transactions on accounts and other factors such as market condition change.